30 January 2023

Following the announcement of the winter budget on 17 November 2022, RSM polled 1000 consumers to gauge their sentiment towards discretionary spend in 2023. You can find the full results of our survey here.

There’s no doubt consumers are being hit hard by the current economic climate with 98% saying they are concerned about the cost of living crisis, and 37% saying they have no money left at the end of each month after paying for food, energy and household bills. Below you’ll find our analysis of how these findings fall into the broader retail landscape in 2023, and the outlook for inflation, input costs, mergers and acquisitions, and employment.

Grocery and clothing take a direct hit

Top five areas consumers will cut back

Our survey found that socialising is one of the first things consumers will cut back as they tighten their belts due to the rising cost of living. As a result, clothing and accessories will take a direct hit with respondents less inclined to update their wardrobes in 2023. In better news, categories that will be less impacted include fitness and wellbeing, pet food and products, and clothing and products for children – with only 7% of survey respondents planning to cut back in these areas. Habits formed in Covid-19 lockdowns around health and wellbeing are clearly now entrenched, and as a country of animal lovers, pets are taking precedence alongside our children.

In more alarming news, our survey shows declining sentiment around essential spending on energy consumption and groceries. Concerns around bills are seeing 45% of consumers plan to cut back on energy and 30% on grocery products. With food and alcohol inflation, (the main contributor towards headline inflation) rising 17 months consecutively, from minus 0.6% in July 2021 to 16.9% in December 2022, it’s no surprise spend on groceries is coming under pressure. Added to this, consumers’ fears around spiralling energy bills indicates even the government’s energy support scheme is providing little comfort, with many focusing on minimising these bills.

The importance of value for money

With the exception of Gen Z, all respondents chose value for money as the most important driver to buy when considering a new purchase. 18–24-year-olds instead chose item quality. This ties in with our findings that Gen Z are the least inclined to trade down to ‘value-range’ products on grocery items and clothing ranges such as the John Lewis ‘Any day’ range, with 27% saying they would not trade down across any retail category.

Outside of the Gen Z anomaly, trading down will be a trend we see roll over from 2022 and into 2023 with 72% of respondents saying they plan to buy more ‘value range’ products in future. What’s telling about these results is that every household is upping the number of ‘value-range’ products they buy, irrespective of income. In fact, despite being the most insulated by the cost of living crisis, it’s the higher income brackets who are upping spend most considerably in this area. For example, those earning £100K+ were the most likely to buy ‘a lot more’ ‘value-range’ products in future (48%).

The second most important consideration to consumers when making a purchase was quality, meaning consumers still want bang for their buck. Interestingly, the least important consideration across all generations was current fashions or trends, which speaks to the changing priorities of consumers today. With ever-increasing input costs, it would be easy for retailers to give in to skimpflation and give consumers lesser products that are cheaper to produce. But consumers are becoming savvier to diminishing quality and are looking for their money to go further. Retailers should take heed from these results.

Sustainability top of mind for high earners and younger generations

With the public becoming more clued up and invested in their impact on the environment, sustainability is an increasingly present concern for many consumers. In terms of areas where respondents would pay more for sustainable goods, eating habits came out on top, with 36% saying they ate less meat than they did a year ago, and an equal amount saying they would pay more to eat at a restaurant who prepared locally sourced food.

In the current climate our survey suggests higher earners feel more able to make environmentally considered purchases. The number of consumers who ate less meat than they did a year ago jumps up to 49% when looking at households with earnings of £60K and upwards in isolation. The younger generations have had a focus on sustainability for some time and our survey reflects this, showing 41% of under 45s also eat less meat than they did a year ago.

Other priorities that emerged around sustainability were recognised green credentials and environmentally friendly production practices. These two trends were particularly appealing to those with earnings over £60K, with 51% of respondents saying they would pay more for sustainably produced products, and the same number saying they would pay more for services from a business with green credentials. Retailers who can trade through the challenging conditions in the first half of the year and appeal to this environmentally focused demographic of consumer, will be in a stronger position on the other side of the recession. With purse strings unleashed, consumers will reward retailers that stuck to their values and make good on their brand loyalty.

Finally, circularity is a key trend that many in the retail industry are taking advantage of. With increasing entrants to the market selling second-hand goods, and more established retailers setting up resale markets or adding vintage lines to their product ranges, there’s a marked shift towards meeting the demand for pre-loved goods from consumers. Leading categories from our research were clothing and accessories, furniture and household goods, and technology. However, a stark shift across the generations emerged when it came to those consumers who would consider purchasing second hand. In the over 45 demographic, a striking 49% of respondents said they wouldn’t purchase second-hand goods in future, compared to 20% of the under 45s.

Omni-channel experience wins out

Apart from Gen Z, who ranked shopping online as their preferred way to shop, all other age groups favoured shopping in-store over online shopping. The diminishing gap between these two modes as a preference supports the rise in omni-channel shopping; where online and in-store channels work in harmony to reduce lost sales. Consumers are increasingly using stores to ‘try before you buy’ but making the final purchase online once they’ve weighed up their options and sought out the best deal on price.

These findings certainly chime with the latest results for online as a proportion of all retail sales. The huge increases in online traffic during the pandemic may have dropped back, but the upward trend in internet shopping we saw pre-pandemic continues to notch up. Online sales are now broadly consistent at around 26% of all retailing, which is over 6% up on pre-Covid levels with February 2020 internet sales accounting for 19.8% of all sales. As the long-term trajectory for internet shopping continues, the sector keeps recalibrating and reassessing the purpose of stores, considering which sites lend themselves to being ‘experience’ led. In future it’s likely we’ll see shops become the show room for products, whilst online becomes the ultimate point of sale.

Outlook for sales performance

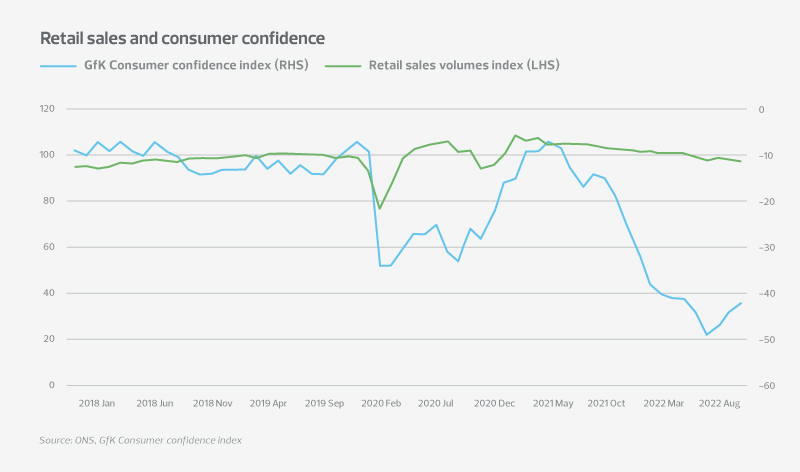

Economic headwinds had a severe impact on retail sales at the end of 2022. Even promotional offers in the lead up to Black Friday and Christmas couldn’t tempt consumers to up their basket size and sales volumes for the three months to December ended 5.7% down on 2021. The outlook for consumer spending in 2023 is bleak and we estimate total spend to decline by 2% for the year.

Our survey data suggests that brands sitting at the top end of the market who have largely been unscathed by dwindling discretionary spend, may now begin to feel the squeeze. Concern over the rising cost of living stays consistent when viewed across all income brackets, with high income households just as concerned as low-income households. As we enter the first quarter of 2023, these brands may start to see the general malaise begin to drag on sales and will need to fight hard to maintain share of spend.

Admittedly, consumers have a huge pile of savings equivalent to around 10% of GDP. But given consumer confidence is at a record low, we aren’t expecting them to dip into these savings by much.

Many retailers are going to feel left out in the cold in Q1 with consumers feeling the post-Christmas strain on their finances. Bright spots should come through towards the end of H1 in spring when consumer spending will be less constrained by energy bills and an uptick in positivity will flow through to early autumn. However, with retailers’ buying decisions for winter on the horizon, what’s still unclear is how this winter and the Golden Quarter will play out. With reduced support for consumers and their energy bills from April; uncertainty about what will happen with the Russian war in Ukraine, and ambiguity surrounding the desire of consumers to dip into their nearly £200bn pot of savings, predicting demand will be more challenging than ever this year.

Consumer price index should slow with peak inflation behind us

CPI inflation peaked and reached a 40-year high in October 2022 at 11.1%. The headline rate shot up due to electricity and natural gas prices jumping to the level of the Government’s Energy Price Guarantee, and quickly rising prices for food and other goods. The peak in CPI inflation was followed by a reduction in both November (10.7%) and December (10.5%) which came about after four consecutive months of falling Input Price inflation from July to October 2022. This relieved some of the pressure on retailers, allowing them to reduce the price of goods where they had been passing on increased costs to consumers.

Bearing in mind the consistent fall in Input Price inflation, the good news is that CPI inflation has probably peaked. The government’s energy price cap, in place until April, will ensure there are no further rises in household utility bills in the winter period. Added to this, wholesale natural gas and electricity prices have recently fallen to levels seen at the start of the war in Ukraine. This means inflation is likely to steadily edge down over the year and we expect it to fall from 10.5% currently to about 4% by the end of 2023.

Market consolidation will continue

Retail deal volumes in 2022 compared with 2021 decreased by just over 26%, but this wasn’t unique to retail. 2021 saw the largest number of deals globally in over two decades, with deals that would have ideally seen the light of day in 2020, getting pushed back into 2021. In addition, new consumer buying behaviours borne out of the pandemic created huge shifts in the retail market, increasing activity.

In 2023, its likely we’ll see the continuation of themes that emerged in 2022, with bigger retailers snapping up struggling brands where there are synergies with their existing platforms and portfolios. Bringing new acquisitions under the group umbrella will afford opportunities through existing infrastructures and footprints, bringing about commercial benefits and economies of scale. Advantages include better cost controls with more efficient warehousing, cheaper distribution, and storage costs. These benefits will help return acquired brands back to profitability and ease the supply chain disruptions which are tipping so many retailers over the edge.

Those with weak ecommerce businesses also present opportunities for consolidation. There are several success stories across conglomerates like M&S and Next, where they are breathing new life into brands that had previously struggled to adapt to the digital shopping experience. Housing a range of brands in one platform has proved a winning formula and other retailers will no doubt look to replicate this going forward.

Staffing crisis continues to ease

Vacancies in the retail sector hit their peak in March 2022 at 169K. This reduced towards the end of the year with the latest ONS data showing vacancies just 10% higher than pre-pandemic levels, and unchanged year on year in Q3. With the expectation that the retail market will contract in 2023, the pressure on vacancies will continue to ease and pressure on staff costs will also play into this.

Vacancies in the wholesale and retail sector

The latest ONS data showed the number of people employed in the retail sector was down significantly since before the pandemic at the end of Q3 (-13.3%) when compared with the UK national average of -0.1%. Like many consumer-facing industries, lots of workers that left retail during Covid-19 chose not to return and the sector now has a fight for talent on its hands as a result. However, as the market shifts and contracts, but vacancies remain relatively high, we anticipate the fall in employees we’ve seen in retail since the pandemic will ease somewhat in 2023.

Wages in 2023 will prove a heavy burden for retailers and are set to increase despite the fall in vacancies. Competition for talent remains fierce with the latest ONS data from Q3 showing earnings rose 7.1% year on year, which was above the national average of 4.9%, but well below inflation which hit 10.1% in the same period. The existing pressure on earnings will only be compounded by the government’s National Living Wage (NLW) increase – which comes into force in April. With retail employing a high proportion of the UK’s workers paid NLW, and staff wages making up an average 15% of their cost base, the industry will feel the pinch on balance sheets this year.

Insight from RSM UK’s Head of Retail, Jacqui Baker:

‘Consumers’ finances are taking a direct hit and they have little choice but to tighten their belts. With retail sales volumes significantly down on 2021 levels at the end of 2022, our survey indicates this trend will continue with nearly every category across retail impacted by dwindling discretionary spend.

But there were bright spots in these results too. Those retailers who can pivot quickly to offer value for money and take advantage of the demand for own-brand products as consumers trade down, will put themselves in good stead for the first part of the year. Come summer, with consumers feeling less pressure on their energy bills and with a renewed sense of purpose as holiday season returns, we anticipate an uplift for retailers as the depression of the winter months eases. Winter 2023 is still shrouded in mystery, as who knows where we’ll be with the war in Ukraine; government support for energy bills, or industrial strike action. But with inflation and interest rates predicted to take a downturn around this time, there’s everything to play for when it comes to the Golden Quarter next year.’

To discuss this analysis, or any business issue you may be facing in the current climate contact our expert: