17 March 2023

It was already a 50:50 call as to whether the Monetary Policy Committee (MPC) would hike interest rates next week, even before the latest turbulence in financial markets. It now looks like the MPC will probably press pause on its tightening cycle a little early, but may include some hawkish forward guidance if inflation indicators don’t move the right way.

Afterall, there is little cost to it pausing now. The MPC was only ever going to raise interest rates by 25-basis points (bps), which, in the context of the near 400-bps of tightening that has already happened, is of little real consequence.

If the MPC does keep interest rates at 4% next week then this should be thought of a hawkish pause, rather than a decisive end to its tightening regime. The MPC could easily raise rates in May if financial market stresses had eased and inflationary conditions, especially in the labour market, were still sufficient. A strategic pause would give the MPC an additional two moves to examine how its previous rate hikes had impacted the economy.

As a result, we now expect the Bank of England (BoE) to keep rates on hold at 4% next week. However, this is far from a foregone conclusion. The European Central Bank (ECB) chose to raise interest rates by 50-bps yesterday despite the issues in the financial markets being even closer to home, so there is a good chance the BoE ignores the financial markets and presses ahead.

Financial conditions tip the balance

The economic data we have had since the last MPC meeting in January has been mixed.

On the dovish side, headline inflation has started to fall. More importantly, core and services inflation has dropped sharply. The BoE cares much more about services inflation, as it is much more closely related to the domestic economy than the headline rate of inflation. At its last meeting the Bank implied that if the economy evolved in line with its forecasts, then it probably wouldn’t need to raise interest rates again. Given January’s CPI print was bang in line with the BoE’s latest forecast, it argues for a pause.

On the hawkish side is the extremely tight labour market. Admittedly, the slowdown in private sector pay growth will embolden those on the MPC who think that interest rates have already risen by enough to bring inflation back to the 2% target. But at just 3.7% the unemployment rate is telling us that the labour market is still too tight for the MPC to relax. What’s more, even though more students are joining the workforce, the number of people saying they can’t work because they are sick, is still increasing. That will keep the participation rate low and keep upward pressure on wage growth.

In the neutral camp is the rebound in GDP in January, which was more related to the return of Premier League football after the World Cup hiatus than any genuine underlying economic strength. Indeed, the underlying trend is still negative and consumer-facing sectors, such as art and recreation, were only able to regain a quarter of December’s loss. In addition, the Budget shouldn’t give the MPC much to worry about. It was slightly more generous than expected, but most of the additional spending went on supply side measures so the impact on medium term inflation should be neutral.

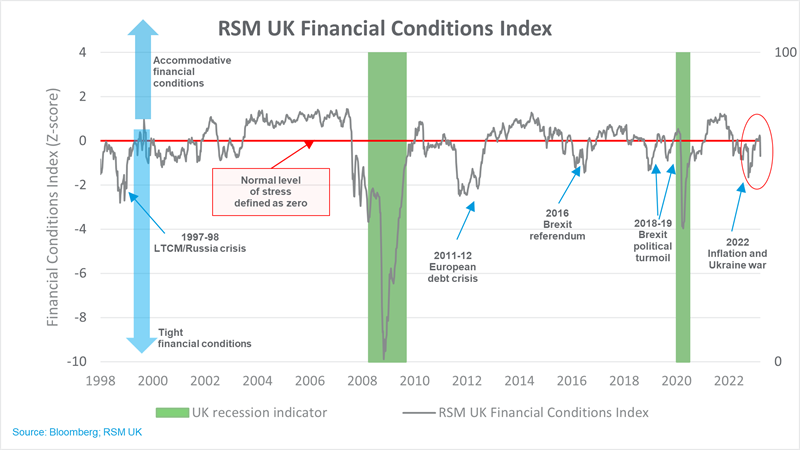

Looking purely at the economic data, a 25-bps rate hike was probably a 50:50 call. But all of the above will probably be overshadowed by the recent turmoil in financial markets. The severe tightening in financial conditions will be a drag on growth unless there is a rapid rebound, which seems unlikely. That will do some of the MPC’s work for it and negate the need for additional rate hikes. What’s more, by hiking again the MPC would risk exacerbating any pressures facing the financial sector.

Of course, much like the ECB, the BoE may decide that there is little risk to the UK financial sector and the volatility in the financial sector is mainly noise. In this case, its concerns over inflation would take precedence and a rate hike would be back on the table.

For what it’s worth, given the economic data is finely balanced, we think it would be sensible to delay a rate hike, while giving forward guidance that further hikes may come in the summer, depending on the economic data.