Our creditor solutions team can provide you with services ranging from interactive portfolio risk management, advice on problem debtor strategy, through to debt collection and outsourced insolvency claims management.

We can help you to identify and monitor potential customer and supply chain risks, allowing you to take action sooner to reduce bad debt risk and maximise returns. We will create tailored collection strategies to mitigate losses and support recoveries in both pre and post insolvency situations.

We work with businesses across the utilities sector, banks, and asset-based lenders, where typically there are mass customer portfolios to monitor. We also have many clients within the accountancy and legal fields.

Our team offers a range of solutions tailored to your needs, including:

- Tracker – Cloud-based software that transforms credit risk management, improves marketing and sales efforts, and informs business decisions;

- Portfolio Risk Manager (PRM) – A live interactive whole portfolio reporting tool that helps you identify, categorise and manage risk;

- Debt Management – A bespoke approach to debt recovery to recoup as much of the money you’re owed as possible;

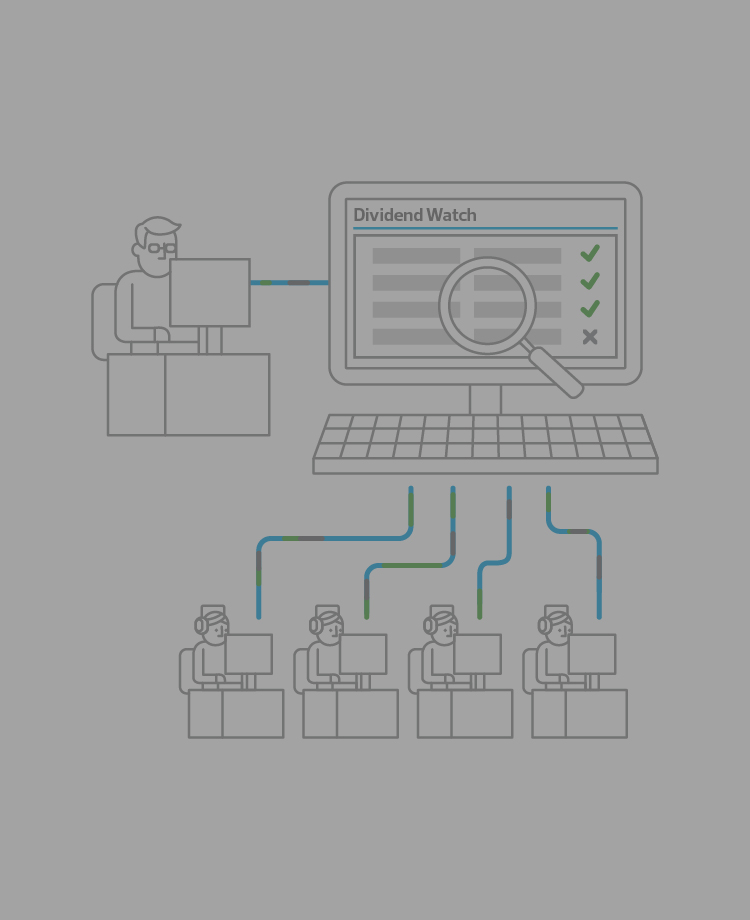

- Dividend Watch – An industry-leading outsourced insolvency claims management service for corporate and personal insolvencies suffered within your customer base; and

- Creditor Assist – A variety of strategic solutions designed to enhance returns and minimise bad debt risk where our clients have customers who are slow in paying, non-paying and/or at risk of insolvency.

Where appropriate, we will work collaboratively with a number of our service line teams, including restructuring and special investigations, to get the best possible result for you.

If you’d like to find out more about our creditor solutions, please get in touch with Keith Marshall.