Making Tax Digital for VAT

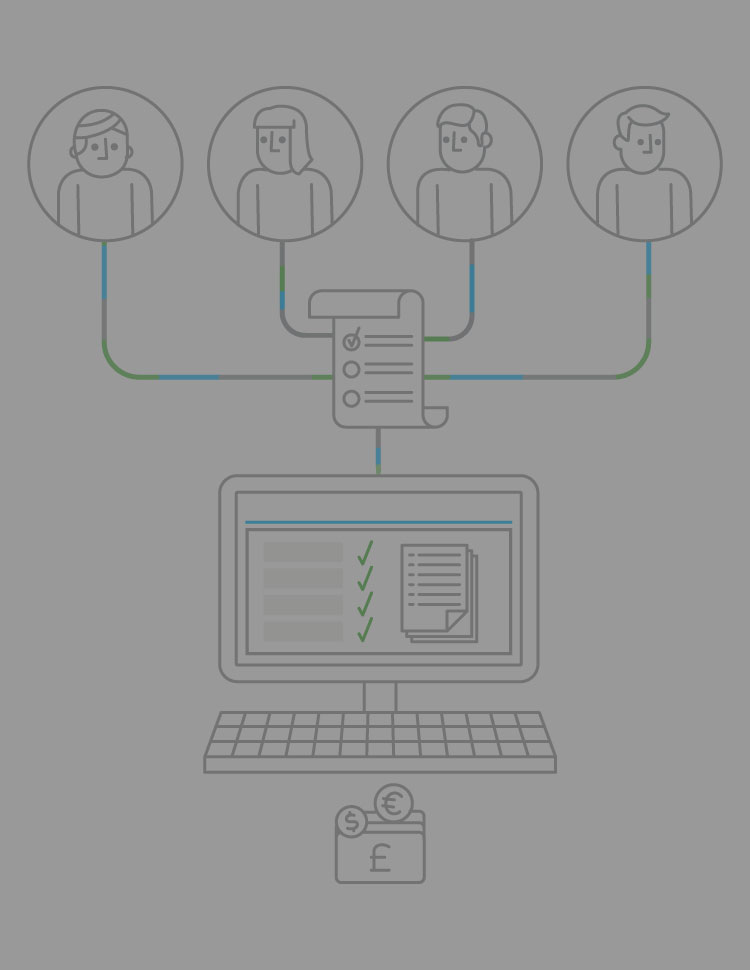

Making Tax Digital for VAT provides a reliable and easy to use solution for RSM clients to meet their MTD filing requirements. The cloud-based solution integrates with Excel, allows you to import data in CSV format and submit information via a tried and tested API connection.