08 September 2020

The International Accounting Standards Board (IASB) has released an exposure draft which proposes to replace IAS 1 Presentation of Financial Statements with a new standard. The new standard retains some key requirements from IAS 1 and aims to improve the comparability and usefulness of financial statements by:

- specifying how revenue and expenses should be classified;

- defining new subtotals to be disclosed in the statement of profit and loss;

- introducing new disclosure requirements for management performance measures; and

- clarifying the requirements regarding aggregating and disaggregating financial information.

Structure of the statement of profit or loss

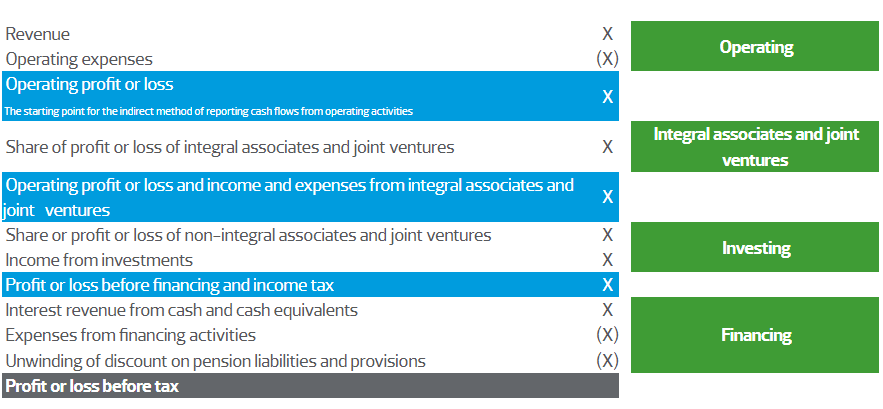

Three new subtotals have been proposed in the income statement, as indicated in blue.

In applying the new subtotals, to ensure that the subtotals remain comparable and useful for users of the financial statements, it is also proposed that an entity should classify income and expenses by category, as indicated in green.

The entity would be required to distinguish between integral and non-integral associates and joint ventures accounted for under the equity method. Integral associates and joint ventures are those closely related to the entity’s main business. All other associates and joint ventures would be classified as non-integral and subsequently included within the investing category.

The operating category would include income and expenses from an entity’s main business activities. Therefore, where the main business activity of the entity is financing or investing, income and expenses related to such activities would be included in the operating category, as opposed to the investing or financing categories.

Entities will have a choice to present their operating expenses using either the nature or function of expense method. The exposure draft seeks to clarify the distinction between the methods but entities may welcome more guidance on how to apply them.

The new classification of income and expenditure will have implications for the classification of forex and some fair value movements (including derivatives). It is proposed that such movements in the income statement would be classified according to the classification of the related income or expenditure.

Roles of financial statements - aggregation and disaggregation

The exposure draft includes principles for, and additional guidance on, the general requirements for the aggregation and disaggregation of information in both the primary statements and the notes. It also includes specific requirements to provide more useful information about items often described as “other” eg other expenses.

All entities would be required to disclose unusual income and expenses in a single note rather than presenting them separately on the face of the income statement. “Unusual income or expenses” would be those that have limited predictive value and those where similar items (by type and amount) are not expected to arise for several future annual reporting periods.

Management performance measures (non-GAAP measures)

Previously, alternative subtotals to the three new subtotals are likely to have been used in the financial statements, to aid users in their understanding. The exposure draft brings in the concept of ‘management performance measures’ (MPMs) and requires them to be disclosed in a single note to the financial statements.

MPMs are subtotals of income and expenses that:

(a) are used in public communications outside financial statements;

(b) complement totals or subtotals specified by IFRS Standards; and

(c) communicate to users of financial statements management’s view of an aspect of an entity’s financial performance.

It is worth noting that ‘public communications’ is a very broad term and some commentators would prefer MPMs to be limited to non-GAAP measures used within the entity’s annual or interim reporting.

Although the measures will be bespoke to each reporting entity, they will be required to ‘faithfully represent’ aspects of the entity’s financial performance.

Details on how the measures are calculated and how they provide useful information would need to be disclosed. In addition, they would have to be reconciled back to the most directly comparable total or subtotal specified by IFRS standards. The one proposed exemption to this requirement is in respect of EBITDA.

The IASB has not defined EBITDA as there is generally no consensus on the definition. It has instead included ‘operating profit or loss before depreciation and amortisation’ as a defined term.

Other minor points

Some existing requirements will be relocated to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors or IAS 7 Statement of Cash Flows.

The presentation requirements proposed will not apply to interims prepared under IAS 34.

If you require any further information, please contact Danielle Stewart.