30 January 2023

Following the announcement of the winter budget on 17 November 2022, RSM polled 1,000 consumers to gauge their sentiment towards discretionary spend in 2023. You can find the full results of our survey here.

There’s no doubt consumers are being hit hard by the current economic climate, with 98% saying they are concerned about the cost of living crisis, and 37% saying they have no money left after paying for food, energy and household bills at the end of each month. Below you’ll find our analysis of how these findings fall into the broader travel and tourism landscape in 2023. This includes the outlook for consumer demand, outbound travel, sustainability, and our predictions for the shape of the sector following ATOL reform, which the industry expects clarity on this year.

Holidays a priority for consumers in 2023

After being locked down for months during the pandemic, travel is one of the last areas consumers are willing to cut back on in light of the cost of living crisis. Post lockdown the trend for ‘revenge travel’ is in full swing, with only 10% of survey respondents planning to cut back on long-stay holidays of five days or more, and 14% planning to cut back on short-stay trips of 1 – 4 days. When we compare this to eating and drinking out, where 40% of consumers are planning to cut back on spending, it’s clear travel is still a priority for consumers in 2023.

Though in some areas of spend, such as eating out and grocery shopping, it is possible to trade down to increase value, it’s unlikely we’ll see the same trend in travel any time soon. Afterall, if you’re used to staying in a 4* all-inclusive resort, it’s unlikely you’ll enjoy a holiday at a lesser venue without the same facilities. Particularly when it’s associated with a higher one-off cost. Instead, what’s more likely, is we’ll see consumers cut the duration or frequency of their holidays to save money or change to a cheaper destination. Where Spain might have been the location of choice in the past, a destination like Turkey may offer better value, but potentially the same standard of holiday and accommodation consumers have enjoyed previously.

Top end of the market to win out

High-end travel operators and agents are set to win out in 2023. This is largely due to high-income households being much less impacted by the cost of living crisis than low-income households. Therefore, demand will be much less muted for these households.

Indeed, the latest ONS data shows the highest 12-month inflation rate was recorded among the bottom three income deciles. This is because energy consumption and food and drink expenditure tend to reflect a greater proportion of lower income households’ spending, with around 15.2% of total expenditure on these categories for low-income groups, and 10.4% for high-income groups. This strain on finances is reflected in the demand for overseas holidays across the two income groups as shown in our survey findings.

Of those high-income households with earnings over £60K per year, 54% are planning a long-stay trip overseas in next 12 months. This number comes down to 22% when we compare it with low-income households with earnings of £20K and under. The disparity between these two groups becomes even greater when we consider short-stay breaks overseas. 44% of high-income households plan to take a short-stay trip overseas in the next 12 months, whilst this figure quarters when we look at low-income households to 11%. Many agents and operators have already planned their offering accordingly for 2023, with many cutting lower end products from their range.

What’s encouraging to see across all groups is that every income bracket has increased their plans to take a long- or short-stay trip overseas this year when compared with 2022. This is more pronounced for long-stay trips, where 38% of all respondents plan to take an extended trip this year, compared with 30% in 2022. Short-stay trips also see an increase this year, but only marginally with 22% planning a short break overseas compared with 20% who took a short break last year. Clearly the chance to take a prolonged escape from the current doom and gloom is appealing to many consumers and early indications from January’s bookings (the peak sales month for the industry) are in line with this.

Sustainability important to high-income households

Impact on the environment is increasingly a concern for consumers. In turn, buying behaviours are beginning to change as living sustainably becomes more embedded in the consumer psyche. But the rising cost of living is hampering consumers good intentions, and this is evident in our survey findings. Sustainable purchasing often comes with a higher price tag. This might go some way to explaining our findings that nearly 40% of consumers disagree with the statement ‘my travel plans are influenced by their impact on the environment’, with only 28% in agreement.

However, these findings change dramatically when we view them by socio-economic background. For those households with earnings over £60K, 45% agree their travel plans are influenced by their impact on the environment, and 33% disagree. Whereas for households with earnings under £60K, this figure comes down to 25% who agree, and 41% who disagree. Underlining this sentiment towards sustainable travel, 51% of those survey respondents with earnings over £60K said they would pay more for services from a business that has recognised green credentials.

With high-income households having more headroom in their budget to consider environmentally friendly spending, any travel business operating at the top end of the market should be weaving sustainable initiatives into packages as an easy win. From using hotels with greener credentials and offering restaurant bookings with outlets serving locally sourced food (for which 54% of high earners are prepared to pay more). To considering sustainable options when it comes to transport – could electric vehicles be secured for transits, for example? Holidays might not be the first thing consumers think of when it comes to reducing their impact on the environment, but for those agents and operators with an audience who will readily pay for greener services, these businesses can lead the way.

Families and the over 55s most likely to holiday aboard

Staying in the UK is less popular this year than going abroad, with 49% of respondents planning a holiday overseas. If we drill into the survey data further, families were the most likely group to travel in 2023, with 75% saying they would go on holiday this year.

Holidays abroad are important to families, and this group were more likely to travel overseas than those without children. Recent research by ABTA in their 2023 Travel Trends Report indicates that 57% of young families who book holidays will book an all-inclusive package to help them manage the cost. According to ABTA members, this is already coming through in bookings with Travel Republic, Barrhead Travel, TUI, Jet2holidays and easyJet holidays all seeing an increase in bookings for all-inclusive breaks as consumers look to secure the cost of their holiday upfront.

41% of over 55s didn’t go on holiday last year. When compared with the under 55s, this figure comes down to 21%. But 2023 looks to be the year older travellers regain their confidence to travel in the aftermath of coronavirus. Particularly the 55–64-year-olds where 44% of these consumers plan to take a long-stay trip overseas in the next 12 months, compared with 29% who travelled overseas for a long stay in 2022. Though less pronounced, we see a similar jump in the over 65s, with 33% of this group planning a trip of five days or more overseas in the next 12 months, compared with 23% who went overseas in 2022.

Barriers to travel in 2023

Whilst the number of consumers who do not plan to have a holiday this year has reduced when compared with last year (29%), 25% of respondents said they did not plan to take a holiday in 2023. The price of an overseas holiday along with the associated costs are top deterrents to consumers who might have travelled abroad in the past. In better news, fears around coronavirus and travelling overseas are waning, with only 16% of those not planning to go on holiday this year giving concerns around the virus as their reason.

What’s not captured in these survey results is the impact of December’s border force strikes on consumer sentiment. With strikes focused on airports and taking place over key travel dates during the Christmas period, it’s likely we’ll see this unrest roll on through 2023 until an agreement between all parties can be found. For now, however, swift government action thwarted any major impact to public travel plans over Christmas and insulated the sector from further negative press. But with the Prime Minister saying a rise in public sector pay would negatively impact the recovery of inflation, and with industrial action notching up across public sector industries, it’s not likely we’ll see a resolution to these issues any time soon.

Outbound travel numbers defy dire consumer confidence

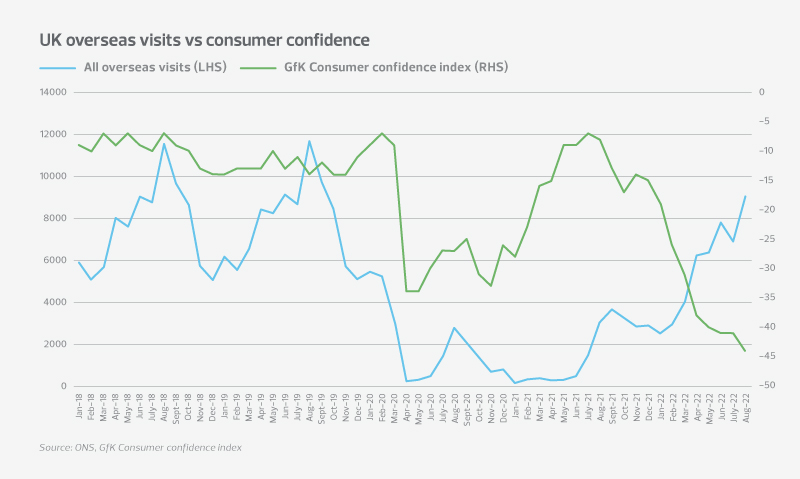

The latest ONS data reveals visits abroad are still down compared to pre-Covid-19 levels with 20% less visits abroad in July 2022 (6.9m) compared with 8.6m visits in July 2019. Key trading in August 2022 saw visits down 22% on the same month in 2019 at 9.0m, compared with 11.6m in 2019.

However, more encouragingly the same data shows overseas visits by UK residents are finally beginning to follow a similar pattern to what was usual pre-pandemic. There was a 12% decrease between the number of overseas visits in June and July from 7.8m, to 6.9m visits. Visitor numbers then increased significantly in August to 9 million, an increase of 31%. Visits abroad by UK residents show the same pattern between 2017 and 2019, indicating the beginning of more normal trading patterns for the travel industry from 2022 and into 2023.

The GfK consumer confidence index (which started in 1974) recorded the lowest reading on record at -44 in August 2022. With confidence already on its way down in January – the key booking month for the sector, it’s encouraging to see intention to travel unimpacted by this dire sentiment. Even more so in fact, when considering that travel was the last sector in the economy to begin its recovery with the release of all Covid-19 restrictions not until March 2022. When viewed through this lens, travel agents and tour operators should be feeling buoyant about the year ahead. With the desire to travel trumping several major economic headwinds last year, and with the signs that 2023 will be a tough, but hopefully more stable year politically, travel businesses have everything to play for.

Clarity on ATOL reform essential for full recovery of the industry

The capacity in ATOL authorisations are now 2% higher at the end of 2022 (26.3m) than they were in 2019 (25.7m). This suggests the travel industry is expecting demand in 2023 to return to pre-pandemic levels. Despite this optimism however, the size of the market has become smaller and there are now 236 fewer ATOL license holders in 2022 than there were pre-Covid in 2019. This is good news for bigger players in travel who will benefit from increased demand in a smaller marketplace. But, for the wider recovery of the industry, both large and small travel businesses must be able to operate on a level playing field. One of the key factors impacting this is uncertainty in the wake of the CAA’s proposal for ATOL reform.

Mass flight cancellations and government travel restrictions during the coronavirus pandemic meant any travel businesses with an ATOL authorization licence had to refund customer deposits within 14 days of cancellation. Normal business practice at this time was to use part of these deposits as working capital. This weakness in the operating model caused severe cashflow pressures across the industry and numerous business closures. In a bid to avoid a similar set of circumstances happening again, the CAA launched a consultation on ATOL reform which would require travel businesses to separate customer money into a trust, escrow or separate accounts. Or to provide bonds, or a combination of the two, in addition to paying an ATOL Protection Contribution (APC) on bookings and moving to a variable rate of APC.

Though not confirmed yet, for many small- and medium-sized business, these new stipulations from the CAA could be the death knell. With appetites in the lending market for travel low following numerous economic setbacks, and interest rates reaching the highest levels we’ve seen in a long time, securing funds to operate in this framework could be impossible for many smaller businesses. But despite these obvious draw backs, government has signalled that reform must happen.

We expect that the package travel market will become increasingly dominated by large agents and operators in the future. It’s also likely we’ll see the rise of businesses operating accommodation and excursion-only models where flights are not included. These models will become the hot target for investment with Private Equity houses and the like buying into a much reduced financial and regulatory burden. However, with nearly two years since the CAA announced its consultation, the travel industry’s next evolution cannot be fully realised until a decision is made and certainty is given. We therefore anticipate that though 2023 will be a better year for travel, the industry’s full recovery won’t be made until 2024 or possibly later depending on what the CAA decide.

Insight from RSM UK’s Head of Travel and Tourism, Ian Bell:

‘2023 feels like a homecoming for travel and despite oncoming economic headwinds, the signs are good for the industry. Consumer demand looks set to be strong for the year and outbound travel behaviours have begun to convert back to pre-Covid patterns. This is all positive news, and the industry should be feeling buoyant.

With lower income households bearing the brunt of the cost of living crisis, many travel businesses will have hedged their bets early and cut cheaper packages from their portfolio. But even high-income households will be scrutinising spend this year and businesses will need to work harder than ever to secure share of spend.

The fight for talent continues to be the major challenge in 2023 with the industry feeling the squeeze of a tight labour market. As the fallout from the recession plays out, we might see this ease somewhat, with zombie businesses propped up by Covid support in other sectors finally unravelling.

A resolution to ATOL reform is top of the wish list for many in the sector this year. Whatever the CAA decide, certainty will allow the industry to finally move on from Covid-19 and unleash the potential for what the shape of the sector might look like in future.’

To discuss this analysis, or any business issue you may be facing in the current climate contact our expert: