17 January 2022

Graham Bond, Co-Head of Life Sciences, argues that the life sciences sector is well placed to take advantage of the pharmaceuticals industry’s positive economic conditions.

The life sciences sector is set to continue its very strong run and will be an increasingly important provider of growth for the manufacturing sector and the wider economy. The sector is a source of highly productive jobs, attracts foreign direct investment (FDI), and is mostly based outside of London and so helps to reduce regional imbalances.

An uneven recovery

The UK economy, as a whole, is almost back to its pre-crisis level, at least according to monthly GDP measurements. But the recovery has been uneven – the transportation sector is still 6 per cent below its pre-crisis level, whereas the healthcare sector is 12 per cent above.

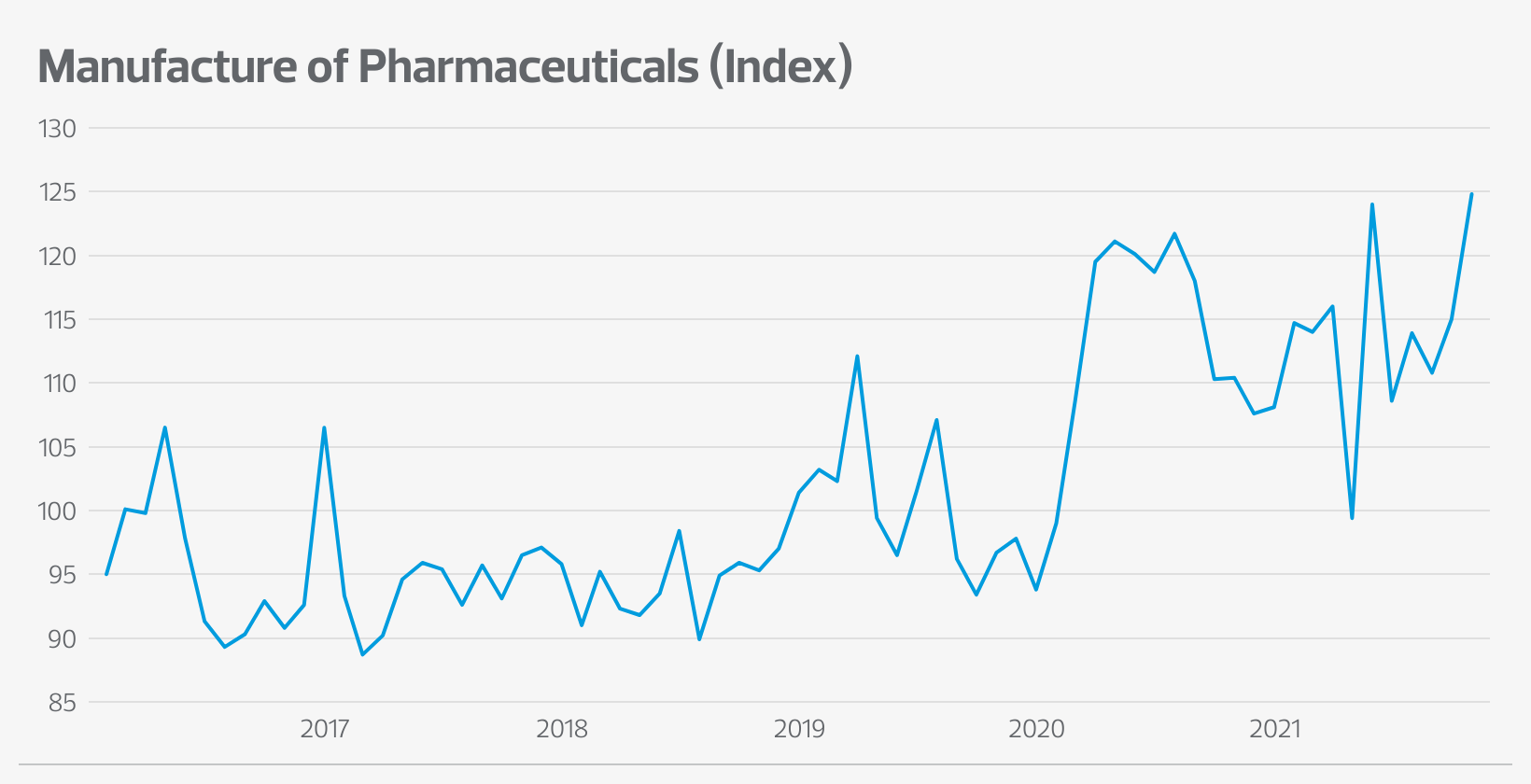

Unsurprisingly, given the success of developing a vaccine during the pandemic, the volume of pharmaceuticals manufactured in the UK has rocketed since late 2019. The general life sciences sector has also performed exceptionally well over the last few years, growing by 20 per cent since 2018. As a result, life sciences is becoming an increasingly important part of the modern UK economy: Pharmaceutical production is already 5 per cent of industrial production and employs 250,000 people.

However, the UK exports only a fraction of the amount of medical technology that its peers in Europe and America manage to export. It also punches below its weight in exports of pharmaceutical products; in 2019, the UK accounted for only about 2.8 per cent of worldwide patients recruited to medical studies.

Ongoing benefits to the wider economy

There is, however, a wealth of evidence that the recent boom in the UK life sciences industry is set to continue. Part of this is because the UK has a competitive advantage in life sciences. The UK’s world class universities (including four of the world’s top ten for life sciences and global life sciences innovation), highly educated workforce and well-respected regulatory framework have made it second only to the US as the world’s biggest destination of FDI. UK companies accounted for 60 per cent of the total biotech capital invested in Europe in 2019. Demand for life sciences facilities is so great that the first specialist life sciences Real Estate Investment Trust is looking to list on the London stock market, with an aim to raise £300m.

All of this additional investment in R&D and infrastructure bodes well for future production and export of pharmaceutical and medical products. The industry is set to grow by 5 per cent a year and could account for 400,000 high productivity jobs by 2025. Not only is this good news for those in the life sciences industry, but it will also benefit the wider economy in three keys ways:

Workers employed in the life sciences industry are, on average, twice as productive as workers in the rest of the economy. More productive workers tend to be paid, and consume, more, further boosting economic growth through the economic multiplier effect.

Life sciences hubs tend to be based outside of London and the South East, which are already the most productive regions of the country. Boosting the life sciences industry will improve productivity and economic growth in the rest of the UK, in line with the government’s ‘levelling up’ agenda.

The life sciences industry is a significant source of FDI into the UK (ie when companies outside of the UK invest in the UK). Industries with a high level of FDI tend to be more productive and create more jobs.

The upshot is that the life sciences sector is becoming an integral part of the UK economy and will be a key booster of wider economic growth over the next few years.

If you would like to discuss any of the issues raised in this article. or have any questions about life sciences, please contact Graham Bond or Laragh Jeanroy.