08 December 2021

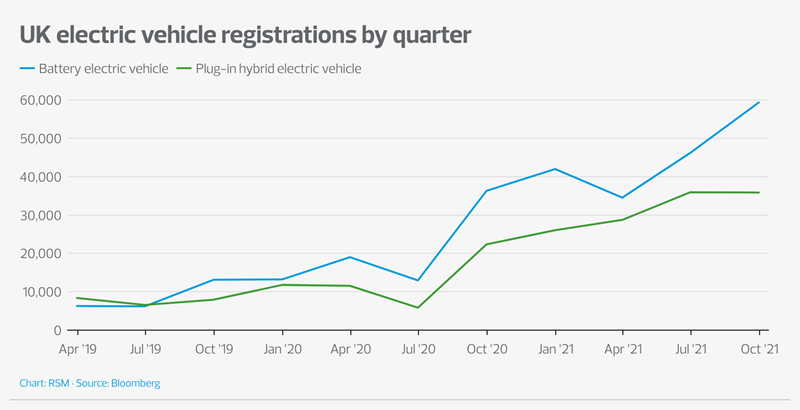

Electric vehicles (EVs) have travelled from an emerging technology to commonplace on UK roads. 59,343 battery electric vehicles were registered in the quarter to 30 September 2021, with 35,853 plug-on hybrids registered in the same period. This compares to 36,300 and 22,350 respectively in the same quarter last year.

Better batteries, greater range and a more comfortable journey

The battery in an EV is its number-one cost element. As the technology has improved, the cost of batteries has reduced – making the vehicles more affordable. There are EVs for all budgets hitting the market that offer increasing range between charges, with some exceeding 300 miles.

EV batteries are still very heavy. However, this weight can be spread low in the floor of the vehicle. This helps with vehicle design as it allows for a more creative use of cabin space and better weight distribution.

The driver of a traditional rear wheel drive saloon will be aware of the benefits of 50/50 weight distribution. The design philosophy of these vehicles often places the engine as far behind the front wheels as possible creating a long, rakish bonnet. As a result, friends and family in the rear have less space as the cabin is compressed and the drive shaft typically runs through the centre of the vehicle.

These design restrictions do not exist in the same way for EVs, which leads to greater potential for creative use of space in the design of the vehicle. More space in the vehicle makes them more comfortable for the longer journeys they are now capable of – and 50/50 weight distribution can still be retained for the driver’s enjoyment.

Curing range anxiety with better infrastructure

Improved vehicles mitigate range anxiety – but drivers will still need to be confident they can charge their vehicles as conveniently as refuelling a more conventional car.

The rapid advances in battery technology go hand in hand with improvements in the infrastructure around charging points. The EV charging infrastructure is a crucial aspect of addressing range anxiety. RSM’s report ‘The Real Economy: Infrastructure’ found that 68 per cent of survey respondents felt that the infrastructure in the UK is restricting the growth of the national economy. And over 60 per cent felt this was impacting their business and the local economy.

So, how connected is the charging infrastructure in the country to the uptake in electric vehicles? And is more investment needed to make EVs a real option for more consumers?

Charging your EV in the UK

For drivers in the UK there are three charging options.

- Slow – 3-5kw charging through a ‘standard’ plug, with a charge time of 8-24 hours

- Fast – 7-22kw charging, with a charge time of a few hours

- Rapid / Ultra Rapid – 25-100kw plus, with a charge time of less than an hour depending on vehicle

Availability of rapid chargers is key. For many the ability to slow-charge your vehicle at home is a luxury only afforded to those who have a garage or driveway. Readily available rapid chargers allow more flexibility on car parking and ownership – including on-street parking and communal residential parking. The tipping point of convenience will be the point at which an EV can be recharged at the same speed as visiting a petrol station. Increased innovation in the world of battery technology means we are travelling towards this point. .

Finding a rapid charging point in the UK

Tech company Zap Map track the growing availability of chargers in the UK on a daily basis. As of early December there were almost 16,000 fast chargers in the UK, almost 4,000 rapid chargers and over 1,000 ultra-rapid chargers.

The UK government has announced a £950m Rapid Charging Fund to future-proof electrical capacity across the motorway and A-road network, as well as committing to at least six high-powered, open-access charge-points at each motorway service area by 2023. By 2030 this is expected to rise to 2,500 high powered charge points across England’s motorways and A-roads, rising to 6,000 by 2035.

The Rapid Charging Fund covers the motorway and A-road network (in England), but what about urban or rural areas? The private sector and manufacturers may have a role to play here. For example, McDonalds announced a partnership in 2020 with Instavolt to install rapid chargers at existing drive-through restaurants. In the United States, General Motors recently announced a scheme to deploy 40,000 EV chargers across the US and Canada as part of a $750m plan to expand public charging options across rural and underserved rural areas. These are just two examples of the private sector and automobile industry stepping in to supplement the infrastructure. Others will undoubtedly follow.

Is this enough?

There are challenges. There are over 8,380 petrol stations in the UK – that indicates more than 50,000 fast chargers would be needed if each petrol station installed six at their premises. Increased numbers of chargers will require investment in the national grid and the redesign of many forecourts.

The UK government do believe the Rapid Charging Fund is sufficient to support the anticipated growth in EV ownership across the UK. The government announced further legislation in late November 2021 that mandates charge points in new-build homes and large-scale renovations which will add a further projected 145,000 charge points a year.

Whether this investment in infrastructure is enough remains to be seen but momentum is moving in favour of the EV. The UK government’s stated objective is clear - to make EV charging as easy as refuelling a petrol or diesel car today. Private sector and manufacturer investment may be required alongside government support to achieve this.